Life Insurance For Cancer Patients in 2025

You might think that life insurance for cancer patients is impossible, but thats not the case.

Cancer is a terrible disease that affects many people. When you are diagnosed with cancer, it can be stressful and scary to think about the future because there’s no telling how much time you have left.

Life insurance for cancer patients can help provide security and peace of mind during this difficult time.

What do you think? Do we need more information on life insurance for cancer patients?

Table of contents

- Life Insurance for Cancer Survivors

- Best Life Insurance for Cancer Survivors

- Can You Get Life Insurance After a Cancer Diagnosis

- Life Insurance For People With Cancer

- Life Insurance For Terminal Cancer Patients

- Life Insurance and Cancer

- Can You Get Life Insurance If You Have Cancer

- Life Insurance With Cancer

- Conclusion

- FAQ

Life Insurance for Cancer Survivors

We are here to answer all your questions, especially the most asked question by our clients. Can you get life insurance after being diagnosed with cancer? PinnacleQuote is here for you!

Cancer patients usually have to face a unique set of challenges to get life insurance coverage…

Can I get life insurance if I have been diagnosed with cancer now or in the past? We will discuss the best life insurance policy for pre-existing conditions for cancer patients. Let’s begin…

To emphasize, getting coverage for pre-existing conditions for cancer patients is possible to obtain. However, it shouldn’t discourage you from buying life insurance.

Again, no matter your pre-existing medical conditions or health issues, everyone has the right to life insurance, regardless of the type of cancer.

Above all, whether you smoke cigars or looking for life insurance for smokers, the surgeon general states that smoking causes some cancers along with heart disease.

Best Life Insurance for Cancer Survivors

Above all, getting life insurance for someone with cancer that is active is next to impossible. In fact, breast cancer and life insurance or thyroid cancer life insurance are common types. However, if you have active cancer and is being treated, then a guaranteed issue type of policy will be the only one.

Can a cancer survivor get life insurance?

To tell you the truth, yes, but it will depend on what grade, stage, and treatment. For example, depending on the type of thyroid cancer will determine whether you can get coverage or how much you will have to pay.

For instance, Anaplastic Thyroid Cancer is the most aggressive and depending on how fast the tumor grows will determine treatment. Also, Medullary Thyroid Cancer is the most common. Overall, depending on the stage, grade and treatment will be the determining factor if you will be a thyroid cancer survivor.

Can You Get Life Insurance After a Cancer Diagnosis

Getting coverage will depend on life insurance cancer remission guidelines and carrier. For instance, getting term life insurance for cancer patients will only take place if you have some distance between the last treatment and remission.

Now if you were diagnosed with testicular cancer coverage will not be possible. However, GI is an option. But you can get life insurance after testicular cancer as long as you stay in remission for at least 3 years.

Life Insurance For People With Cancer

All in all, most people understand why life insurance after cancer is so important.

Whether it is a term life insurance for cancer survivors policy or a whole life policy — it’s the best way to ensure that those you care about are financially secure after you pass. All in all, providing a death benefit!!

In fact, the good news is, there are always options for those seeking cheap life insurance.

Life Insurance For Terminal Cancer Patients

For example, getting an affordable burial policy might be your only option.

However, life insurance for terminally ill cancer patients may only have a choice of guaranteed life insurance for cancer patients.

In general, if you have been cancer-free and in good health condition for more than five years, then you may be able to get an affordable life insurance policy such as a 20-year term.

Life Insurance and Cancer

Medical Underwriting

- I have cancer can I get life insurance?

- Can you buy life insurance if you have cancer?

- Can you get life insurance with cancer?

These are questions that I am asked often. Is there life insurance for cancer patients? YES, there is!

After a cancer diagnosis, getting life insurance with cancer, in particular, is one of the main reasons it’s so important for people to compare multiple life insurance companies.

Getting the best life insurance quotes after cancer will determine who you pick. It is important to know how much the medical underwriting varies from company to company.

In fact, this means, in turn, that the prices will also vary for your life insurance policies, so it’s useful to compare rates before choosing a plan. For this reason, this can potentially save you a lot of your premiums when shopping cancer life insurance quotes.

Life Insurance Policy For Someone with Cancer

As a patient, with regards to life insurance and cancer, you will need to answer several questions about your condition. It’s best if you go in informed and prepared to answer them.

We’ll list some potential questions below:

- Does this disease run in your family?

- Have you received any cancer treatment?

- What kind of cancer? (Such as lung cancer, thyroid cancer, colon cancer, Prostate cancer, etc. )

- How long ago diagnosed?

- What’s your current condition? Treatment Plan?

When applying for life insurance remember, it’s always best, to be honest, and answer each question as thoroughly as possible. Underwriting will request all medical records along with an accurately completed application.

The more honest you are, the more likely you are to being accepted by an insurance company. However, having this awful disease along with any other health impairment like multiple sclerosis will likely be a decline.

Keep in mind, after filling out the application the waiting periods may feel like they take forever. Be Patient! All of this will pay off in the end with the best life insurance coverage for you and your family.

Cancer patient life insurance is not easy! But dealing with the right agent is the best place to start.

Life Insurance For Parents with Cancer

Above all, it is a stressful experience when one of our parents becomes ill with cancer. For instance, oncology visits, treatment strategies, second opinions, and the unknown.

Life insurance for cancer patients will depend on so many factors. For starters, the pathology report will be looked out to see what grade, stage, and treatment was recommended.

In general, the process can be very expensive so hopefully, having health insurance for cancer patients in remission will be helpful and relieve stress.

It’s important to deal with an independent agent that knows the carriers that specialize in pre-existing conditions like cancer.

Having the right agent can get you the very best life insurance quotes for cancer patients.

Can You Get Life Insurance If You Have Cancer

Can I buy life insurance if I have cancer?

A scary question. A question that we hear on a daily from our clients. The kind of cancer you have/had is extremely relevant when you apply for term life insurance for cancer victims.

When life-threatening, the harder it is to get insured. Leukemia, for example, may have a lot of trouble getting accepted. However, a guaranteed issue life insurance will accept anyone.

To get the best life insurance coverage. What to know!

However, there are things you can do. For one, you can get much lower life insurance rates if you wait until a few years after your last treatment before going to apply.

This way, insurance companies will be able to see that your condition hasn’t worsened or reappeared.

You always want to make sure that you are working with several of the best types of life insurance companies, such as Banner Life.

As we mentioned earlier, each insurance company will have different medical underwritings. However, there are some general ratings that must follow, at least loosely.

It would be difficult for patients to get above a standard rating unless their illness was non-melanoma skin cancer. For most other types of cancer, a standard rating is most likely the best possible rating.

Consulting with your independent agent will help narrow down your insurance options.

Most Common Cancer Diagnosis For Men and Women

Is life insurance after cancer diagnosis challenging to get?

What is equally important then where can I get life insurance with cancer, is the waiting period and factors that will determine the rate.

For instance, life insurance for ex-cancer patients will vary depending on the type of cancer, stage, and whether or not cancer spread. In many cases, the pathology report would also be taken into consideration.

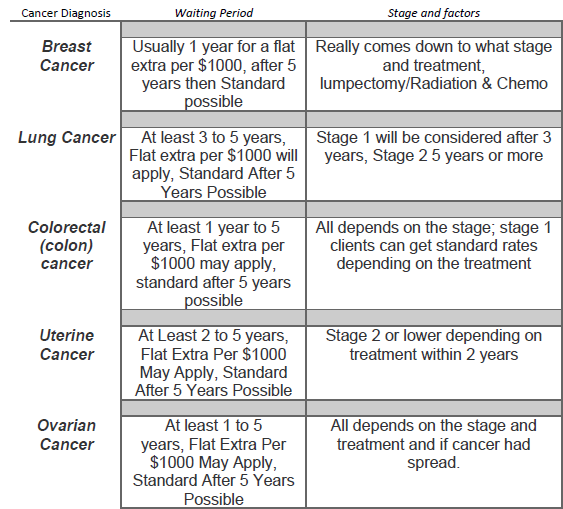

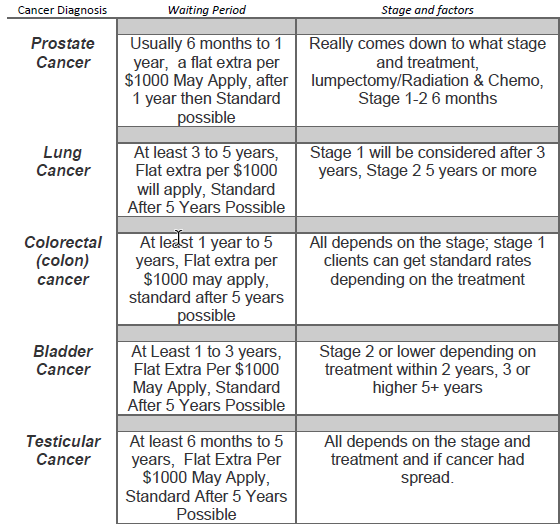

In addition, cancer varies for both men and women. The table below will show the top 5 cancer diagnosis for men and women.

Together with the waiting period and stage, we will determine the amount of time it will take before you even can get a traditional term life policy.

Top 5 Cancer Diagnoses For Women Looking For Life Insurance

Top 5 Cancer Diagnoses For Men Looking For Life Insurance

Life Insurance With Cancer

HOW CAN I GET BETTER LIFE INSURANCE RATES

Quit Smoking!!!

Will life insurance that covers cancer cost more?

If diagnosed, you’ll likely be considered a high-risk applicant by the life insurance companies. This means you’ll need to pay significantly higher premiums.

However, there are many things you can do to lower your rates. We’ll list a few things that can have a significant impact on your insurance rates:

- Quit all tobacco products — Life insurance for smokers usually pay 2 to 3 times more for life insurance! So quit smoking!

- Eat healthier

- Exercise frequently

- Anything else that improves your overall health

- Don’t have a DUI or reckless driving on your record.

The healthier you seem, the more likely a life insurance company will want to insure you.

Furthermore, even if your looking for life insurance in your 30’s or life insurance over 50, you will be considered a special risk because of cancer history.

High-risk disease: When diagnosed with high-risk disease, you’ll also be requested to answer a range of questions that pertain to the specific disease.

By way of instance, when it comes to life insurance with cancer, then an insurance provider may ask the following:

- When diagnosed?

- If in remission, the length of time?

- What drugs are you taking?

- Do you have any other pre-existing medical problems? Such as asthma, diabetes?

- What has been the consequence of any additional medical follow-ups?

Best Life Insurance For Cancer Patients

Can you get life insurance if you have cancer?

During Treatment? Life insurance after a breast cancer diagnosis?

All very good questions!

The answer is yes! Even if you are in the process of treatment there are policies available to you. In fact, during Chemotherapy and/or radiation treatment you can get guaranteed life insurance for cancer patients.

Yes, you heard that right. The best coverage during cancer treatment would be with AIG or Gerber Life. These carriers will both have a graded period of 2 years and a maximum of $25,000.

This would at the very least provide burial insurance for cancer patients.

Above all, these policies will refund 100% of the premiums for the first two years plus 10% so you won’t have to worry about a terminal cancer life insurance payout.

So life insurance for breast cancer survivors will be able to get more than a guaranteed issue policy if in remission after 5 years from last treatment. See, Above.

This is usually the best avenue to achieve life insurance for terminally ill cancer patients.

CAN YOU GET LIFE INSURANCE IF YOU HAVE CANCER

With over 200 kinds of cancer, it is among the most common ailments we pay serious illness, and most people can relate to this illness, either personally or utilizing a friend or family member.

Due to the unfortunate likelihood that you might at some stage be affected, it could be a fantastic idea to defend you and your family’s financial security.

You can do this by taking out a life insurance policy with critical illness insurance cover. In addition to this awful illness, we also cover against HIV, some heart conditions and a range of other illnesses.

If covered by Critical Illness, then it’s very good to learn your pay-out will cover any extra costs from the impact of your diagnosed ailment.

DOES LIFE INSURANCE COVER CANCER

WILL I BE INSURED

Can you get life insurance when you have cancer? In the event that or If diagnosed, many people ask does life insurance cover cancer?

Furthermore, if you’re in partial or complete remission, getting life insurance and critical illness coverage is possible but won’t be guaranteed. It’s possible that the cost will increase or specific medical requirements excluded from protection.

The best method to find out if getting life insurance is by finishing a quote with us. Regardless of your situation with cancer, maintaining a nice and balanced lifestyle while avoiding alcohol or smoking will put you in the best possible location health-wise.

Finally, remember it is important that you answer questions about your health and medical history correctly and honestly — if you don’t, it might invalidate your policy.

LIFE INSURANCE WITH CANCER HISTORY

What is your family history?

Can I get life insurance if I had cancer? First, documentation of certain types of cancer includes hereditary links, however complete only a tiny proportion of cancers have a genetically inherited link.

Furthermore, upon discovery that you have inherited a faulty gene which increases your risk, “predictive genetic testing” could be carried out.

Then, these evaluations will help to show if you’ve got a high risk of developing this awful disease.

In case you’ve got a high incidence of this illness in your family or genetic testing has revealed that you have an increased risk of developing cancer, will leave your premiums impacted.

This greater danger however also suggests that investing in life insurance and critical illness coverage may be a sensible decision should the worst happen. To repeat, life insurance with cancer history is obtainable.

So, when it comes to life insurance with a cancer history, most companies will want to know if any of your parents or siblings has died, or if diagnosed before the age of 60.

Can You Get Life Insurance After Cancer

YES!! But it depends…

The first thing to remember is that the MIB provides reports on nearly three million patients. Oncologists, physicians and clinical research across the USA submit reports to the database, in which nameless patients assigned a few. Second, Insurance companies then get the information for underwriting purposes.

In addition, Insurers can review patient demographics, morphology, diagnosis phases, first-course therapies, tumor locations, and follow-up processes.

It’s unusual if an insurer delivers a policy to someone who’s still undergoing treatment. If they have a good prognosis, they may become eligible for a policy.

Life insurance companies frequently examine medical records and physician’s reports for breast cancer survivors seven years following a finished treatment.

In case the prognosis is good, the individual can request a re-evaluation and lower premiums.

Most survivors who apply for life insurance do so after five decades of being cancer-free.

When it comes to life insurance for seniors with cancer, Insurance companies with strict underwriting rules will probably need to determine that an applicant has been cancer-free for at least 24 months.

They may also want to confirm that the applicant lives a very healthy lifestyle

Life insurance for Cancer Patients In Remission

PinnacleQuote is here for you!!!

How to get life insurance after cancer? Buying life insurance for cancer patients in remission may be more challenging and more pricey. But it is achievable.

Depending on the type of cancer you may qualify for a guaranteed acceptance policy. Underwriters will want to know the type of cancer when you were diagnosed, when you started remission, where the location is, current medications, etc.

Above all, If you have had cancer and are in remission, contact your independent insurance agent.

The first thing to remember, be honest and as accurate as possible with your medical history. We WILL guide you as to the best carrier and best price!

In this case, let’s take a look at some statistics here in the United States over a period of time regarding this awful disease.

Be mindful in giving full details as it will be less frustrating during underwriting.

Can you get life insurance if you are terminally ill

Yes. These are guaranteed issue policies. No health questions. Level benefits.

However, similar to graded policies in the fact if you die within the first two years, your beneficiary will receive all premiums paid into the policy plus 10% (depending on the carrier, some vary). If you die within the first two years due to an accident, the beneficiary will receive the full payout.

These policies are mainly for burial insurance or sometimes called final expense policies.

INSURANCE RATINGS AND LIFE INSURANCE POLICY FOR CANCER PATIENTS

Understanding Ratings

The point often overlooked, is that life insurance policy for cancer patients, the coverage and price you receive will hinge on the curability of your cancer.

Specifically, certain sorts of non-melanoma skin cancer, for instance, are thought to be very low risk by life insurance companies, along with a skin cancer background might not affect premiums at all.

Life insurance firms use these courses to determine your premium:

- Super Preferred (also known as Preferred Plus)

- Preferred

- Standard

- Substandard

There are usually ranges within these classes, also, for example, “Standard Plus.”

Again, based on your type of illness, the life insurance might incorporate a surcharge, also referred to as a temporary flat additional. In the event that this happens, it is due to the risk involved with cancer survivors in the first few years of remission.

With this in mind, applicants with common and treatable types of breast, prostate, thyroid and esophageal cancer may be able to get a more “standard” score under perfect circumstances.

In particular, individuals with a history of leukemia or colon cancer may fall to a “substandard” or “high substandard” score at best, or receive declines. For instance, anyone with cancer which has metastasized likely will not be able to acquire a policy.

Therefore, most insurance companies will not offer a policy to someone who is still undergoing treatment.

In the event that you cannot find a life insurance coverage on your own, you may have the ability to get life insurance through your employer at a “group” rate.

HEALTH IMPAIRMENT/ RISK SPECIALISTS

Furthermore, while some dedicated life insurance agents can shop the insurance market to locate the best rates and best carriers that are affordable, some agents specialize in locating life insurance for people considered “impaired risks.”

We specialize in getting our client’s life insurance with impaired health!!

These agents are…..PinnacleQuote agents!!

Call Us Today To Go Over Your Options 855-380-3300

Is Cancer a Pre-existing Condition

Unlike health insurance plans and health insurance companies there is no enrollment period or open enrollment for life insurance. In regards to health care, an individual health insurance plan is different than life insurance.

Under the federal government health coverage starts at certain time frames of the year depending on when you enrolled. The affordable care act and department of health and human services would have plenty of information. CLICK HERE.

In addition, there is some information regarding the Kaiser Family Foundation. A non-profit organization. Developed to face the many health care issues facing our Nation today. CLICK HERE for more information.

There are a few carriers that will not deny coverage, no matter what your health problem or condition is. AIG, Gerber Life. Just to name a couple.

SHOULD I HIRE AN INDEPENDENT INSURANCE AGENT

YES!!!

Above all, hiring an independent insurance agent can be an excellent investment. For instance, A well-informed and experienced agent will know just where to look, given your condition, and finding life insurance at the lowest rates.

For this reason, even if you have treated high blood pressure and high cholesterol, you can still get preferred rates. In fact, life insurance for diabetics, as long as the A1C is under 7, then-standard rates would be attainable.

What to remember before carriers issue policies…

It’s important to realize, independent insurance agents usually have a good understanding of different companies’ medical underwritings.

This way, you’re more likely to find an insurance company that tends to be more lenient towards people of your risk, thereby giving you a better chance of being accepted, and a better chance at finding a cheaper policy.

Last, even with cancer, life insurance will vary by age. However, life insurance for seniors over 75 years of age will be very expensive if under 10 years since last treatment.

Conclusion

Cancer patients have to face a unique set of challenges when getting life insurance. The process starts with the application, and ends with an approval decision.

For some people who are newly diagnosed or in remission this may be manageable, but for those still undergoing treatment it can mean more steps including medical exams by their oncologist and other specialists before they’re even approved for coverage.

And that doesn’t include any waiting periods between treatments! That’s why we’re here; to help cancer patients get quick quotes from our 24/7 live support team so you know your options as soon as possible.

Get started now by answering these questions about your health status below.”

FAQ

Can you buy life insurance when you have cancer?

Yes you can, if during treatment then there are Guarateed Acceptance Life Insurance

Is cancer covered by life insurance?

Yes, cancer is a natural cause so if a life insurance policy is in place you will be covered. (Excluding Accedental life insurance)

Is cancer insurance a good idea?

Yes, especially if you have a family history of cancer. Having a cancer policy will allow you to get treatment while supplementing lost income.

Can I collect Social Security if I have cancer?

That is something you should take up with the Social Security Administration. You must be eligable and its different for each consumer.

How much is a cancer policy?

When a cost-effective monthly premium in mind, you can get a cancer policy for between $5,000-$100,000. benefits are paid upon diagnosis.

LIFE INSURANCE FOR CANCER PATIENTS VIDEO

American Cancer Society

The American Cancer Society helpline: (800) 227 2345. For More Information CLICK HERE