Is Protective Life Insurance a Good Choice in 2025

Are you considering Protective Life Insurance but unsure if it’s the right fit for you?

Protective Life Insurance has been a trusted name in the industry for over a century, offering a variety of policies to meet the diverse needs of its customers.

With strong financial ratings and positive customer feedback, this provider has built a solid reputation.

In this review, we’ll dive into their policy options, customer experiences, and ratings to help you make an informed decision.

What is Protective Life Insurance

Protective Life Insurance is a well-established insurance provider, founded in 1907. With over 100 years of experience, the company offers a wide range of life insurance products, including term life, whole life, universal life, and indexed universal life insurance.

Key Highlights:

- Founded: 1907.

- Product Range: Includes both temporary and permanent life insurance solutions.

- Reputation: A+ financial strength rating from AM Best, indicating superior ability to meet claims obligations.

Protective Life also partners with Costco, offering exclusive life insurance products to Costco members, making their policies accessible and affordable for a broader audience.

*Ballpark TERM Quote

Types of Policies Offered

Protective Life Insurance provides diverse policy options to meet different financial needs:

Term Life Insurance

- Affordable coverage for a specific period (10, 20, or 30 years).

- Renewable and convertible options available for added flexibility.

| Feature | Details |

|---|---|

| Term Length | 10, 15, 20, 25, and 30 years |

| Issue Ages |

10 years: 18–75 15 years: 18–70 (68 for tobacco) 20 years: 18–65 (62 for tobacco) 25 years: 18–55 (52 for tobacco) 30 years: 18–52 (43 for tobacco) |

| Minimum Face Amount | $100,000 |

| Face Amount Bands |

Band 1: $100,000–$249,999 Band 2: $250,000–$499,999 Band 3: $500,000–$999,999 Band 4: $1,000,000+ |

| Conversion Options | Convertible to various permanent products, including UL and Whole Life. Timeframes depend on the term length. |

| Riders | Accidental Death Benefit, Children’s Term Life Insurance, Terminal Illness Accelerated Death Benefit, Waiver of Premium |

| Grace Period | 31 days (61 in California) |

Whole Life

- Permanent coverage with cash value accumulation.

- Premiums remain fixed for the duration of the policy.

| Feature | Details |

|---|---|

| Face Amount |

Minimum: $1,000 ($25,001 in West Virginia, $100,000 for select rate classes) Maximum: $5,000,000 |

| Issue Ages | 18–80 (non-tobacco, tobacco, juvenile); 0–17 (juvenile only) |

| Policy Fee | None |

| Premium Modes |

Annual: 1.00 Semi-Annual: 0.52 Quarterly: 0.265 Monthly: 0.09 |

| Non-Forfeiture Options | Reduced Paid-Up Insurance, Automatic Premium Loan, Cash Surrender |

| Riders | Waiver of Premium, Terminal Illness Accelerated Death Benefit |

*Ballpark TERM Quote

Universal Life Insurance

- Offers flexible premiums and death benefits.

- Allows policyholders to adjust their coverage as needs change.

| Feature | Details |

|---|---|

| Underwriting Classes & Issue Ages |

18-75 Select Preferred 18-85 Preferred 18-85 Non-Tobacco 18-85 Tobacco |

| Minimum Face Amount |

$50,000 (Non-Tobacco and Tobacco) $100,000 (Select Preferred and Preferred) |

| Guaranteed Interest Rate | 2.5% |

| Maturity Age | No stated maturity age. Premiums and charges discontinue after attained age 121. |

| Premium Load | 25% — applies to all policy years and premiums. |

| Monthly Administrative Charge | $5.50 — applies to all policy years. Discontinued after attained age 121. |

| Monthly Expense Charge | Per $1,000 of initial face amount. Varies by age, gender, and underwriting class. In California, it also varies by duration. Discontinued after attained age 121. |

| Cost of Insurance (COI) Charge | Varies by issue age, gender, underwriting class, years in force, and applicable ratings. Deducted monthly; discontinued after attained age 121. |

| Withdrawal/Partial Surrender Charge | $25 |

| Full Surrender Charge | No charges; a full surrender is available at any time. |

| State Availability | Available in all states except New York. |

Indexed Universal Life Insurance

- Tied to market index performance, offering potential for growth.

- Suitable for those seeking lifelong coverage with added financial benefits.

| Feature | Details |

|---|---|

| Underwriting Classes & Issue Ages |

0–17 Juvenile 18–75 Select Preferred 18–80 Preferred 18–80 Non-Tobacco 18–80 Tobacco |

| Minimum Face Amount | $100,000 |

| Fixed Account | Guaranteed rate of 1% |

| Indexed Account |

100% guaranteed participation rate 3% guaranteed cap rate 0% floor rate |

| Maturity Age | No stated maturity age. Premiums and charges discontinue after attained age 121. |

| Premium Load |

Guaranteed: 8% in all years Current: 8% for years 1–10, 4% thereafter |

| Monthly Administrative Charge | $9 – applies to all policy years, discontinued after attained age 121. |

| Monthly Expense Charge | Per $1,000 of initial face amount. Varies by age, gender, face amount band, and underwriting class. Discontinued after attained age 121. |

| Cost of Insurance (COI) Charge | Varies by issue age, gender, face amount band, underwriting class, years in force, and ratings. Deducted monthly; no charges after attained age 121. |

| Withdrawal/Partial Surrender Charge | $25 – surrender charges may apply on a prorated basis for face decreases. |

| Full Surrender Charge | Applicable in years 1–14 and varies by age, gender, and underwriting class. |

| State Availability | Available in all states except New York. |

Protective Life Insurance Ratings

This provider has earned high ratings from industry experts, demonstrating its financial stability and commitment to customer satisfaction:

- AM Best Rating: A+ (Superior), signifying exceptional financial strength.

- BBB Rating: A+ rating with positive reviews highlighting customer service.

- Customer Feedback:

- Many policyholders praise Protective Life for its affordability and transparent terms.

- Some complaints mention delays in claims processing, which the company has actively addressed.

*Ballpark TERM Quote

Is Protective Life Insurance a Good Company

Hmmm… Is Protective Life Insurance legit? Is Protective Life Insurance a real company?

Protective Life Insurance is a reputable provider with a strong track record of reliability. Here’s why they stand out:

Strengths:

- Financial Stability: Protective Life’s A+ AM Best rating reflects its ability to pay claims without issue.

- Diverse Products: Offers flexible options for both temporary and permanent coverage.

- Customer Satisfaction: Many customers highlight competitive pricing and excellent customer service.

Challenges:

- Some policyholders report delays in claims processing.

- Communication with customer support can occasionally be challenging during high-demand periods.

What are the Pros & Cons of Protective Life

Pros and Cons of Protective Life Insurance

Pros

- Competitive Premiums: Protective is known for offering affordable rates, making it an attractive option for budget-conscious consumers.

- Flexible Term Lengths: With term policies available up to 40 years, clients can tailor coverage to their specific needs.

- Strong Financial Ratings: High ratings from major agencies underscore the company’s financial stability.

Cons

- Customer Service Concerns: Some reviews indicate dissatisfaction with customer service experiences.

- Limited Whole Life Options: Protective’s whole life insurance offerings are less robust compared to competitors, potentially limiting choices for consumers seeking this type of coverage.

Customer Reviews and Complaints

Here’s a summary of customer feedback on Protective Life Insurance:

Positive Feedback:

- Affordable premiums for term life insurance.

- Simple and transparent application process.

- Strong financial backing ensures reliability.

Common Complaints:

- Delays in claims processing.

- Limited responsiveness during peak customer support times.

*Ballpark TERM Quote

Costco Protective Life Insurance Reviews

Protective Life Insurance partners with Costco to offer exclusive policies to members. This partnership provides competitive rates and simplified processes for Costco members, making it an attractive option.

Customer Feedback on Costco Partnership:

- Pros:

- Discounted rates for members.

- Easy online application process.

- Cons:

- Coverage options may be limited compared to non-Costco policies.

Benefits of Choosing Protective Life Insurance

Protective Life Insurance offers several benefits for its policyholders:

- Affordable Premiums: Competitive rates across term, whole, and universal life policies.

- Strong Financial Ratings: Backed by AM Best and BBB for reliability.

- Customizable Policies: Tailored solutions to meet various financial needs and goals.

Who Owns Protective Life Insurance Company

Protective Life is owned by Dai-ichi Life Holdings, Inc which is in the top three of insurers revenue-wise in Japan. Moreover, Dai-ichi life Holdings was founded in 1902 making it one of the oldest mutual insurance companies in Japan.

However, in 2009 it was demutualized and began trading publicly on the Tokyo Stock Exchange. Dai-ichi is an enormous company with over 33 trillion yen in assets, more than doubling the total assets of #2 Tokyo Electric Power.

The company has over 60,000 employees making it one of the biggest employers in Japan!

For more information feel free to visit their website by clicking here.

insurance plans to choose from. It’s important to put a lot of consideration into your choices. After all, picking a life insurance policy is one of the most important financial decisions you can make.

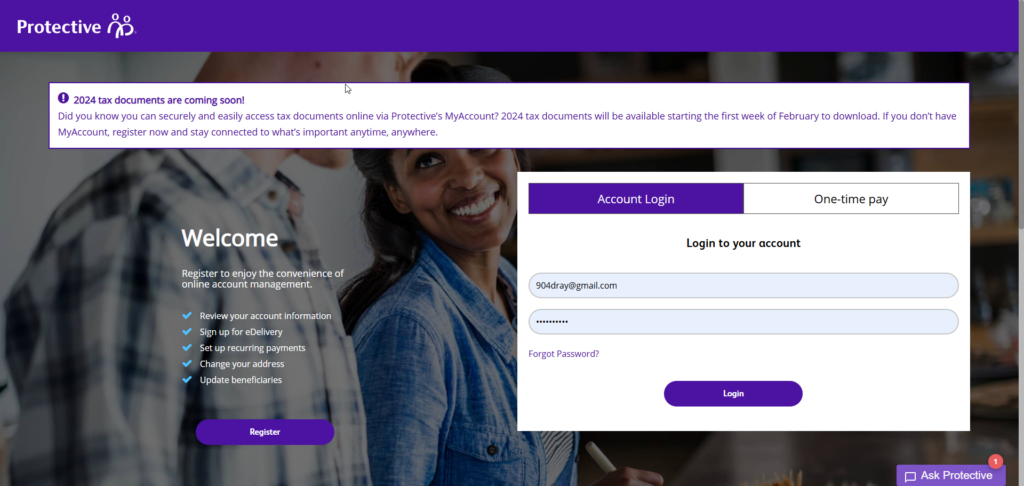

Protective Online Customer Service

Protective makes things simple for you so you can go on living your life and spending time doing what is important ~ Your Family!

Just enter your Protective life insurance login information and you will be good to go! You can do a few things via the online login, such as:

- Review your life policy

- Check Protective insurance claims

- Find Protective insurance company claims phone number

- Check on your Protective annuities

With that being said, we do realize that sometimes it can be frustrating going through automated phone lines and not getting a human on the phone or even having technical difficulties online.

Here at PinnacleQuote, Danny Ray is the Owner/Independent Agent. You get one on one quality service. If you ever have a question that is not answered directly by the company, feel free to contact Danny anytime! (855) 380-3300.

Protective Life Insurance Customer Service Number

If you need to speak to Protective Life Insurance customer service directly, here is their contact information.

Headquarters: PO Box 2606, Birmingham, AL 35202-2606.

Protective Life Insurance Company Birmingham AL Phone Number

Protective Life Insurance Phone number is (800) 866-9933.

Life Customer Service for In-Force Policies

Contact with general questions and inquiries on an in-force policy including policy maintenance, disbursements, and changes such as a premium mode, bank draft, beneficiary, ownership:

Hours of Operation:

Monday – Thursday: 8:00 a.m. – 7:30 p.m. ET

Friday: 8:00 a.m. – 6:00 p.m.ET

Phone: 800.866.9933

Protective Life Insurance Fax Number: 205.268.3402

Email: la****@pr********.com

What they will handle:

- Protective life insurance forms

- In addition to Protective life and annuity information

- If needed they will provide Protective life insurance company change of beneficiary form and much more!

Protective Life Insurance Customer Login

Above all, Protective Life makes it very convenient for the policyholder to access their policy. In fact, here is the link to Protective Life Insurance login for policyholders.

When logged in you can access forms such as Protective Life Insurance company change of beneficiary form. You can also request policy changes, conversions and pay your premiums.

*Ballpark TERM Quote

Protective Life Insurance Agent Login

Here is the Protective Life Agent Login

First, PinnacleQuote is here to help. Second, Speak with one of our agents, and they’ll be able to answer any and all of your questions. Third, We can help set you up with the best life insurance companies and find the most reasonably-priced policies for you. Finally, Working with us will save you a tremendous amount of time, energy, and money.

FAQ

Yes, Protective Life Insurance is a highly rated company with strong financial stability and a diverse range of policies.

Protective Life Insurance provides term life, whole life, and universal life policies for individuals and families seeking financial security.

Protective Life has an A+ (Superior) rating from AM Best, signifying exceptional financial strength.

Costco members can access discounted rates and a streamlined application process through Protective Life Insurance.

Yes, their term life policies are particularly competitive, and they offer flexible premium options for other policies.

Conclusion

Protective Life Insurance is a reliable and reputable provider with a wide range of policies to suit different needs. Their strong financial ratings, diverse product offerings, and customer-centric approach make them a trusted choice for life insurance.

Whether you’re looking for affordable term coverage or permanent solutions, Protective Life Insurance has options to meet your needs. Ready to secure your financial future? Explore their policies today.

*Ballpark TERM Quote

PINNACLEQUOTE LIFE INSURANCE SPECIALISTS, NATIONAL INDEPENDENT AGENT

Above all, you want to make sure when shopping for life insurance that you want to go with an independent agent over a captive agent. Actually, PinnacleQuote is a licensed national independent life insurance agent in 50 states.

At the same time, has relationships with dozens of carriers. In any event, if you’re looking for a simple process, then let PinnacleQuote hold you by the hand. Therefore, we will provide you with the best life insurance rates in the industry, that’s made possible by the relationships we have accumulated over the years.

Ultimately, with 31 years experience in the Investment/Life insurance industries, PinnacleQuote will provide you the best service to protect your family.

Danny Ray Founder/Independent Agent

More Important, If you have any questions, please feel free to contact us at PinnacleQuote (855)380-3300.