2024 Guide On Affordable Life Insurance For Over 50

If you are looking for an affordable life insurance for over 50 years old, you are in the right place!

There are a lot of myths out there about life insurance and how much you should buy. This blog post will set the record straight on what life insurance is, who needs it, and how to find affordable rates over 50. You’ll be surprised by some of the truths revealed in this article!

Can I Get Affordable Life Insurance For Over Age 50?

Life insurance coverage for those over 50, do I qualify? You will find out, keep on reading!

Is affordable life insurance age 50 and over still available? Yes, but you need not kick the can down the road any longer. Well, we aren’t 25 years of age anymore. But this is still achievable!

I am older, I put off life insurance, how do I get affordable life insurance over age 50? You stop procrastinating.

Primarily, health usually declines as we get older which ultimately affects rates. Once you hit 50 years of age, statically most Americans are prone to diabetes, heart disease, and other health impairments.

Consequently, in regards to the cheapest life insurance for over 50’s companies consider older people a higher risk as they approach the mortality age. It is always wise to get coverage as early as possible to lock in your health rating and give you peace of mind.

For instance, for those with any severe medical conditions, it may be difficult to find affordable coverage. Depending on the health impairment, coverage will be less and less affordable.

The way you achieve the best over 50 life insurance is not to put it off anymore as age and health will determine what you pay. In addition, term lengths become more challenging as the 30-year term will bring you over the mortality age when you are in your 50’s.

Best Life Insurance Rates In Your 50’s

How much is life insurance for a 50-year-old?

You always want to shop around insurance companies before deciding on one. Make sure you get 50 years old quotes from the best insurance companies, like Banner Life.

Then, you’ll be able to compare rates and get the best policy that you can. Above all, you want to make sure the life insurance companies you shop for are A/A+ rated with A.M. Best.

We recommend working with one of our experts here at PinnacleQuote. We can connect you with the best life insurance companies for you. In fact, find you the lowest policies.

This is because we know which companies are the most lenient for whatever age, budget, or health categories you fall under. In some cases, just answering a few health questions will be good enough to get coverage, even over age 65.

Even if you are over the age of 50, we can get you connected with affordable coverage. Remember, you don’t want to leave your family with your debts or (funeral expenses) final expenses.

Don’t wait. Every year that goes by, your rates are going to go up. To conclude, these policies provide a lump sum death benefit that is tax-free.

Below are the Life Insurance rates for age 50 to 59 for a male and female.

50 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $50.11 | $64.21 | $79.76 | $149.80 |

| Male Standard | $82.24 | $104.48 | $132.55 | $243.99 |

| Female Preferred | $40.81 | $50.49 | $66.09 | $111.10 |

| Female Standard | $62.09 | $79.37 | $98.51 | $175.19 |

51 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | 54.06 | $70.31 | $87.26 | $170.00 |

| Male Standard | $91.33 | $115.25 | $148.80 | $264.92 |

| Female Preferred | $43.36 | $56.32 | $71.22 | $122.49 |

| Female Standard | $67.94 | $85.67 | $106.72 | $198.75 |

52 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $64.11 | $85.46 | $105.36 | $216.18 |

| Male Standard | $107.07 | $136.69 | $182.36 | $317.85 |

| Female Preferred | $49.61 | $64.17 | $82.55 | $149.78 |

| Female Standard | $79.17 | $98.59 | $127.92 | $245.74 |

53 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $64.11 | $85.46 | $105.36 | $216.18 |

| Male Standard | $107.07 | $136.69 | $182.36 | $317.85 |

| Female Preferred | $49.61 | $64.17 | $82.55 | $149.78 |

| Female Standard | $79.17 | $98.59 | $127.92 | $245.74 |

54 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $70.06 | $94.61 | $116.21 | $246.26 |

| Male Standard | $117.47 | $149.29 | $202.50 | $348.39 |

| Female Preferred | $53.56 | $70.86 | $90.13 | $166.83 |

| Female Standard | $85.36 | $105.81 | $139.54 | $272.64 |

55 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $76.61 | $104.61 | $127.81 | $280.40 |

| Male Standard | $126.41 | $162.87 | $224.24 | $380.88 |

| Female Preferred | $57.76 | $75.97 | $97.66 | $186.10 |

| Female Standard | $91.96 | $111.39 | $150.54 | $303.06 |

56 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $83.46 | $114.41 | $141.41 | $333.25 |

| Male Standard | $135.55 | $177.95 | $244.16 | $429.57 |

| Female Preferred | $61.96 | $82.82 | $108.06 | $234.78 |

| Female Standard | $99.00 | $120.19 | $166.44 | $368.51 |

57 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $91.16 | $124.96 | $156.56 | $375.39 |

| Male Standard | $146.13 | $193.08 | $266.89 | $468.70 |

| Female Preferred | $66.71 | $89.50 | $117.05 | $266.17 |

| Female Standard | $104.00 | $129.83 | $182.06 | $406.35 |

58 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $99.86 | $137.31 | $174.11 | $417.10 |

| Male Standard | $161.32 | $213.89 | $297.88 | $507.83 |

| Female Preferred | $71.96 | $96.80 | $129.65 | $297.13 |

| Female Standard | $115.02 | $144.14 | $202.83 | $443.76 |

59 Years of Age

| Gender & Rate Class | 10yr Term | 15yr Term | 20yr Term | 30yr Term |

|---|---|---|---|---|

| Male Preferred | $110.26 | $150.46 | $194.01 | See GUL to 90 |

| Male Standard | $179.26 | $236.61 | $332.19 | See GUL to 90 |

| Female Preferred | $78.16 | $106.36 | $144.30 | See GUL to 90 |

| Female Standard | $121.99 | $160.92 | $224.02 | See GUL to 90 |

As you can see getting coverage early on will put money back in your pocket. In addition, if you are 59 years of age and looking for a 30-year term then the GUL to age 90 will be the best option.

Life Insurance For 50 And Over

Gen X and Life Insurance

If a decline has happened, they might decide that they just can’t get the coverage needed. However, there is always the option for no medical exam life insurance like a Guaranteed Acceptance Policy.

The most common health impairments at this age are treated high blood pressure, treated high cholesterol, or diabetes. The bottom line, you don’t want to be looking for protection for your family after the Social Security age of 65.

Buying life insurance is the most important thing you can do for your loved ones. Find out why?

Life insurance for 50 years and over, Is It Too Late?

It’s not too late.

We can not overstate the importance of protecting your family. It’s the best way to make sure your loved ones are financially secure when you pass.

Luckily, people over 50 looking for coverage do have several options available. You don’t want to be looking for life insurance over 75, the younger, the better!!

Usually, the 20-year term policy will do just fine in your late 50’s. There is also over 50 life insurance no medical exams available too.

However, before applying, rates will be increased for anyone with serious health conditions or high risk. For Example, like those looking for coverage with diabetes, or multiple sclerosis.

Other factors for special risk are smoking, occupation, and driving record including DUI can have a significant impact on your rates.

Consequently, if you have declined coverage, there is always the guaranteed acceptance insurance policy.

However, it is still very possible to purchase coverage at an affordable rate. Above all, the cost of term life insurance over 50 will be at least double that at age 40. So the sooner you shop life insurance quotes over 50 the better.

For instance, obtaining affordable life insurance over 50 will require good health with a highly rated company. It is also cost-effective to get the coverage that will require a medical exam versus insurance with no medical. This allows the carrier to access risk which will give you a better chance for a more affordable rate.

Furthermore, the underwriting process when applying for a fully underwritten policy will consist of a paramedical exam.

This is when a professional examiner comes out to your house and takes a blood sample, urine sample, height, weight, and blood pressure check.

This usually takes about 30 minutes with a good examiner. The results of the blood test and urine samples are usually known within 3 days of the exam.

Why Buy Life Insurance Over 50?

I’m over 50 Do I Still Need Life Insurance?

Yes — people of any age still need life insurance. Even if you no longer have anyone that is financially dependent on you, there are several reasons to keep coverage active. So it is still important to purchase life insurance for 50 and older.

Check out some of these reasons below:

- Estate Taxes — Without proper coverage, your family may inherit all of your debt and taxes.

- Final Expenses – Final expenses include funeral costs, burial plot, casket, etc.

- Life Insurance as a Means of Savings — With proper protection, you can build up cash value, investing on a tax-deferred basis.

- Retirement/Pension Replacement — Remember, once you’re gone, your loved ones will no longer be supported by any income you may have been receiving, which can leave them financially insecure.

- Income Replacement — If you are married then your spouse probably will depend on you. Securing life insurance for people over 50 will ensure your spouse can have a normal transition in the event of your death.

Above all, in your 50’s life insurance is extremely important in protecting your loved ones.

Best Value Life Insurance In Your 50’s

What Factors Affect Life Insurance Coverage

Secure the cheapest life insurance for over 50 can be accomplished with no history of pre-existing conditions.

Furthermore, a great option would be to apply for a fully underwriting application process. As long as the results come back in range, getting the best rate over 50 will be a lock!

Once you turn 50 you have about 15 years until you receive social security. Overall life insurance rates will triple between ages 50 and 60. So it is very important to shop for the best over 50 life insurance plans.

With life expectancy for men (77) and women (81), the sooner you purchase life insurance the better chance you have to lock at affordable rates.

Because of this mortality age difference rates will always be cheaper for women. See below for over 50 life insurance comparisons.

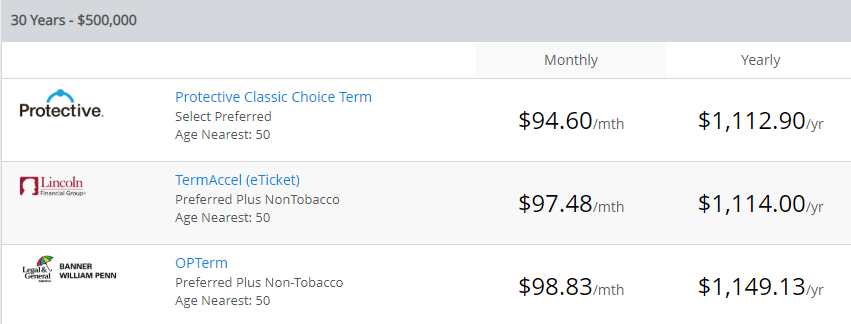

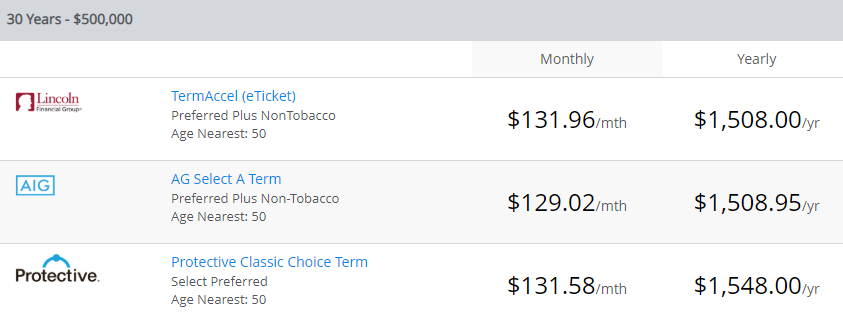

Here is an example of a $500,000 30 year term for a healthy male and female.

Affordable Life Insurance for over 50-year-old woman

Affordable Life insurance for 50-year-old man

Why Is Age Important In Life Insurance?

How are life insurance premiums calculated? These are great questions to ask.

Your age does indeed affect your premium. You can expect to pay more each passing year that you do not secure life insurance for yourself.

It is not only due to your age, but health issues also can arise. Especially if there is a family medical history this can affect your rates. So overall, our health is a big factor. This is why it is so imperative to secure life insurance at the youngest age as possible, or NOW!

To get the best life insurance rates, talk to an expert underwriter at PinnacleQuote! You do not want to pay more for life insurance than you have to. Especially when you are heading to a fixed income.

So if you are over age 50 and your health is great, NOW is the time to purchase insurance so you won’t have to worry about an increase in your premiums because another birthday passed you by or a health issue arises.

Myth: Clients feel they should wait until their birthday to get life insurance or to re-evaluate their current policy. The answer is NO. If your birthday is in June, you want to secure a policy at the very least a month before but preferably 2 months. In addition, most carriers use “Age Nearest”, which makes you a year older 6 months before your birthday.

You want to allow time for the medical exam, underwriting review, and any unforeseen questions or issues that may sometimes arise. If you plan right, you will be able to secure the best life insurance rates for those over 50 years of age.

Term Life Insurance VS. Whole Life Insurance In Your 50’s

Should I get a whole life or term life insurance?

First, you’ll need to decide if you want a term life policy such as a 20-year term or something long-term like a permanent life policy. We’ll briefly explain the difference below:

Term Life Insurance

What is the best age to buy term insurance? A cheap term policy gives you death benefit protection for a designated amount of time. Usually, you can choose coverage terms between 5, 10, 15, 20, or even 30 years. A term life policy is the most basic kind of insurance, but also the most affordable. You may want a 30-year term life policy if, for example, you have a 30-year mortgage on your house. This way, your family won’t be left paying the mortgage off themselves if you pass away. Term policies are the most affordable coverage available. The best age to lock up coverage is when you are in your 30’s.

Permanent Life Insurance

Unlike term life insurance, permanent coverage covers you for your entire life. There are a few other differences. For one, a permanent insurance policy offers cash to build up investment opportunities, where the accumulating money is nontaxable.

Another thing that is different is the premium — premiums for permanent life policies are fixed, so while they may be more expensive than term life policies in the early years, eventually, it can save you money — especially if your health begins to decline.

Whole life is permanent as long as you pay your premiums. However, premiums are level and much higher than term coverage. It’s always best to compare and price term life vs whole life when considering your budget and coverage goals.

To sum up, generally, whole life insurance over 50 years of age is best especially when thinking of final expense insurance.

Although life insurance is cheapest in your 20’s, at this stage of life, your children are grown. You most likely want to make a plan for your burial insurance so that your family, children, and their children do not have that financial burden.

Talk to one of our independent agents and ask them about final expense policies today!

Life Insurance For Parents Over 50

What Is The Insurance That I Should Get For My Parents?

So here you are, the adult children looking for the best insurance policy for their parents. It can be overwhelming and you might be wondering where to begin.

At this stage of life, the best option for your parents is a simplified issue whole life policy. Being a state-licensed field underwriter myself, I specialize in final expense policies for seniors.

These policies are regulated by the financial department of the state you live which is similar to the financial conduct authority in the UK. For my clients from the UK.

Overall, more than half of my clients are seniors. My job is to make sure they get a policy that is the best option and at the best price. This is true whether you are just born, in your 30’s to ’40s, and up to age 90. We have a policy that fits everyone.

Many carriers I offer my clients, specialize in same-day instant approval via a phone interview with the carrier, client, and myself.

You can get anywhere between $1500 -$40,000 in coverage depending on the carrier and state in which you live.

You can call me directly, Lisamarie at (855) 380-3300 ext. 2 or email me at Li*******@Pi***********.com. I look forward to helping you and your parents achieve goals in protecting your loved ones.

Let’s see if you or your parents qualify today!

Life insurance For over 50 Years Of Age, What are Women Paying Compared To Age 40?

What affects the premium rates of my term life insurance?

We said it before, the longer you put off purchasing life insurance, the higher your premiums will be. As you age, your health changes.

And for that reason, it plays a big role in life insurance. Your years of age do matter, here is why. So how much life insurance for a 50-year-old, you ask?

Below are rate charts for a 40, 50, and 58-year old woman for comparison: How much does life insurance cost from age 40-late ’50s?

Rate chart for 40-year-old female:

What is the best life insurance for over 50-year-old adults?

You can see that life insurance for a 50-year-old woman will double between age 40 and 50.

Life Insurance For Over 55 Years Old

Below you can see how even the price over age 55 is significantly higher than at age 55.

Life insurance for 58-year-old female rate chart:

Do Not Get Discouraged!

As you can see from the 3 charts above, as you age your monthly premium increases. In the event that you find yourself in your 50’s and still uninsured. Don’t let that discourage you!

Finding affordable coverage is achievable. Especially if you work with an independent agent. They have relationships with top-rated carriers and underwriters.

In fact, here at PinnacleQuote, we specialize in finding affordable life insurance plans. We will tailor-make you the best policy with the best life insurance premiums to fit your budget.

Medical history, age, and lifestyle do matter, but that is why you talk with your agent. He will help guide you to the best choices.

*To emphasize, at PinnacleQuote we work for YOU! Not the insurance companies. We do not get paid a fee from you at all. Once you are happy and get what you paid for, the insurance company pays us! SO we work for you for FREE. Only when you are satisfied is only when you get paid.

You speak with us, we shop you to multiple carriers at once and go over every detail and answer all your questions.

If you decide on a carrier, then at that point when your policy is accepted by you and in force, (upon receipt of your policy, you still have 30 days to accept or decline your policy) we get paid by the insurance company.

Life Insurance For 50-Year-Old Male

Of course, we cannot leave the Men out of this! Most compelling evidence here is, at least to me, is that the rates in general for women are a bit less expensive!

Life insurance for men over 50 is just automatically going to be more in price than a female. As we have mentioned in the past, statistically speaking, women outlive men.

Rate Chart for a 40 year old male:

Life insurance 50 year old male rate chart:

Again, you can see how important getting life insurance earlier than later will save you an abundance of money.

Best Life Insurance Policy For 55 Year Old And Over – Male

I know I am sounding like I am beating a dead horse. But it’s important to realize how much you will save by getting life insurance for over 55 years old and sooner!!

Rate chart for a 58 year old male:

To Point Out, all the above rates are given until age 58 for example.

The reason I did this was that you can still get a 30-year policy at age 58. Age 59, on the other hand, that option is no longer available. Even life insurance for 51-year-old male will have a difficult time getting a 30-year term

At this point, you could look into a guaranteed universal life policy. This will cover you until age 90.

Types Of Life Insurance Companies for over 50 – PinnacleQuote’s Top A+ Rated Picks!

- Protective Life **

- AIG

- Banner Life

- Prudential

- American National

I am not a big fan of New York life as they are not competitive with pricing.

Life Insurance Over 50 No Medical Exam VS. Medical Exam

No Medical Exam – a no medical exam does not require a nurse to come to your home. However, underwriters will still require a fully completed health/lifestyle medical questionnaire.

Keep in mind, some clients feel by going this route, they will not have to divulge all of the medical history/background or impairments.

This is not the case at all. Be completely honest with your agent and filling out your insurance application.

Medical Exam – This is when you will have a paramedical exam and a nurse comes to your home or even your place of employment to perform a physical exam.

They will draw blood, take your blood pressure and fill out some paperwork that goes hand in hand with the application you filled out with your agent. This is at no cost to you. The insurance carrier pays for this exam. It is at your convenience, your time of day that works best for you.

Overall, it takes no longer than 20-30 minutes of your time.

Life Insurance In Your 50’s

Best Joint Life Insurance Policy

Two types of joint life policies:

- First to die life insurance

- Second to die life insurance

First, what is a joint whole life policy? And what does joint life insurance mean really? It is a policy that covers two lives. These are often called survivorship policies. See below for a description of each. These policies are tricky as only a few carriers will offer this option. Ask your agent if you will benefit from a joint-life policy.

First to die life insurance will pay out a benefit when the first person dies. At this point, the policy will end. However, the spouse who survives could pay off their home mortgage, credit debts, and funeral.

Second to die life insurance. The benefits are paid out when the second insured dies. Most time you would consider this type of policy if you have a small business. This creates protection for personal and company assets from an inheritance tax situation.

If both insureds should die, then the death benefit pays out to the beneficiary. Insurable interest is very important with these policies.

Life Insurance for 50 Years Old, Do I Worry About It Expiring?

Life Insurance that does not expire…

At the end of your term life insurance period, Technically it does not expire. What happens is this. The rate you locked in during that term period expires.

Example term period, 10,15, 20, 25 or even 30 year term period. Renewing your coverage is a cost-effective way to keep coverage in force. Lifestyle changes over time.

What your insurance needs were at 20,30, or even 40, maybe different needs not after age 50. Remember, life insurance can also cover medical bills and other debts.

To get the best life insurance quotes for over 50, speak to your independent agent to go over every option you will have.

FAQs

Age and health are significant factors in determining life insurance rates. Generally, premiums increase as you age. Health conditions that commonly arise after 50 can also impact rates, making it more expensive to get coverage.

Yes, common types include term life insurance, which provides coverage for a specific period, and whole life insurance, which offers lifelong coverage and includes a cash value component.

Consider the policy’s purpose (debt coverage, funeral expenses, inheritance), the premium costs, the coverage amount, and any existing health conditions. It’s also important to review the policy terms and understand the implications of pre-existing health conditions.

Yes, while premiums are generally higher for this age group, affordable options are available. It’s beneficial to compare policies from different insurers, consider a policy with a lower benefit amount if appropriate, and maintain a healthy lifestyle to qualify for better rates.

This depends on individual needs. Term life is less expensive and suitable for short-term needs, while whole life offers lifelong coverage and builds cash value.

Yes, but it might come with higher premiums or exclusions. Shopping around and consulting with insurance experts can help find the right coverage.

Related Articles

Conclusion

You may be surprised at how affordable life insurance can be if you are over 50. The truth is that there are many plans and options available for people of all ages, so don’t wait! Shopping around today could save your family a lot of money in the long run. Today is the day to get started on securing coverage for yourself or your loved ones from our trusted partners because tomorrow might not come as quickly as we think.”

More Life Insurance Resources

- Affordable Life Insurance

- Burial Insurance

- Business Life Insurance

- High Risk Life Insurance

- Informational

- Life Insurance

- Life Insurance Companies

- Life Insurance For Seniors

- Life Insurance with Pre-existing Medical Conditions

- Pre Existing Medical Condition

- Types of Annuities